GenAI Adoption in Singapore’s Banking Sector

Consulting Project Case Study | PwC Singapore × NUS MBA

Project Overview

Industry Focus: Singapore banks (with a focus on retail banking)

Timeline: Jan - Apr 2024

Team Members: Jade Ngoc Khuong, Chanikarn Intaranukulkij, Sejeong Lee, Davide Marino

Core Deliverables: Strategy deck + presentation of market and persona analysis, decision-making analysis (DMU/DMP), and implications for PwC

Framing the Problem - Who owns the pain and who owns the budget?

For the scope of this project, we set out to: (1) map potential GenAI use-cases and the associated challenges for banks, (2) catalogue on-going initiatives, (3) evaluate each organization’s overall AI-readiness, and (4) unpack the GenAI decision-making process. We zoned in on the middle-office and front-office functions for top impacted areas in terms of cost and time savings for GenAI applications, including customer services and risk & compliance.

Risk & Compliance in Middle-Office: GenAI offers opportunities in risk mitigation and real-time policy updates.

We identified 4 systematic pain points: (1) staff and resource deficiency that slows operations, (2) heavy reliance on manual verification, (3) excessive false-positive alerts, and (4) time drain of deal-by-deal compliance checks.

To counter these frictions, GenAI can be a catalyst in turning the risk & compliance function from a manual bottleneck into an adaptive, foresight-driven risk management engine. Banks are already piloting a spectrum of GenAI solutions: copilot” tools that summarise meeting minutes and draft content, automated parsing of unstructured data for suspicious-activity reports, real-time policy updates that run rule-based tests without human intervention, knowledge-base augmentation for legal teams, and continuous document validation during compliance monitoring.

Looking ahead, we spotlight two higher-order opportunities: harnessing Gen AI’s pattern-recognition for predictive risk analytics and empowering models to recommend proactive improvements to existing policies as regulations evolve.

Customer Services in Front-Office: Transforming customer-facing productivity through automation and streamlined processes

Within the front-office customer support function, there are 3 interrelated constraints: (1) legacy core systems with inefficient data access, (2) client negotiation processes that demand synchronous interactions, and (3) low-value and repetitive queries that require extensive cross-referencing.

Early GenAI deployments are addressing these gaps through modular intervention: LLM-powered copilots automate documentation and marketing drafts, real-time analytics engines surface anomalous transactions, and classification models accelerate onboarding compliance. Collectively, these use-cases exemplify digital labor substitution whereby cognitive automation shifts human effort toward higher-order tasks.

The trajectory points to holistic virtual assistants capable of fully managed dialogues, predictive insight engines that anticipate churn or upsell opportunities, relationship-management algorithms that trigger timely human outreach, and data-grounded robo-advisors that deliver personalised financial guidance with improved accuracy.

Survey & Interview Insights

We crafted an 11-question interview guide, and fielded both depth-interviews (n = 11) and an online survey (n = 25) to surface quantitative and qualitative signals to learn more about governance gaps, decision journeys, and organizational AI literacy.

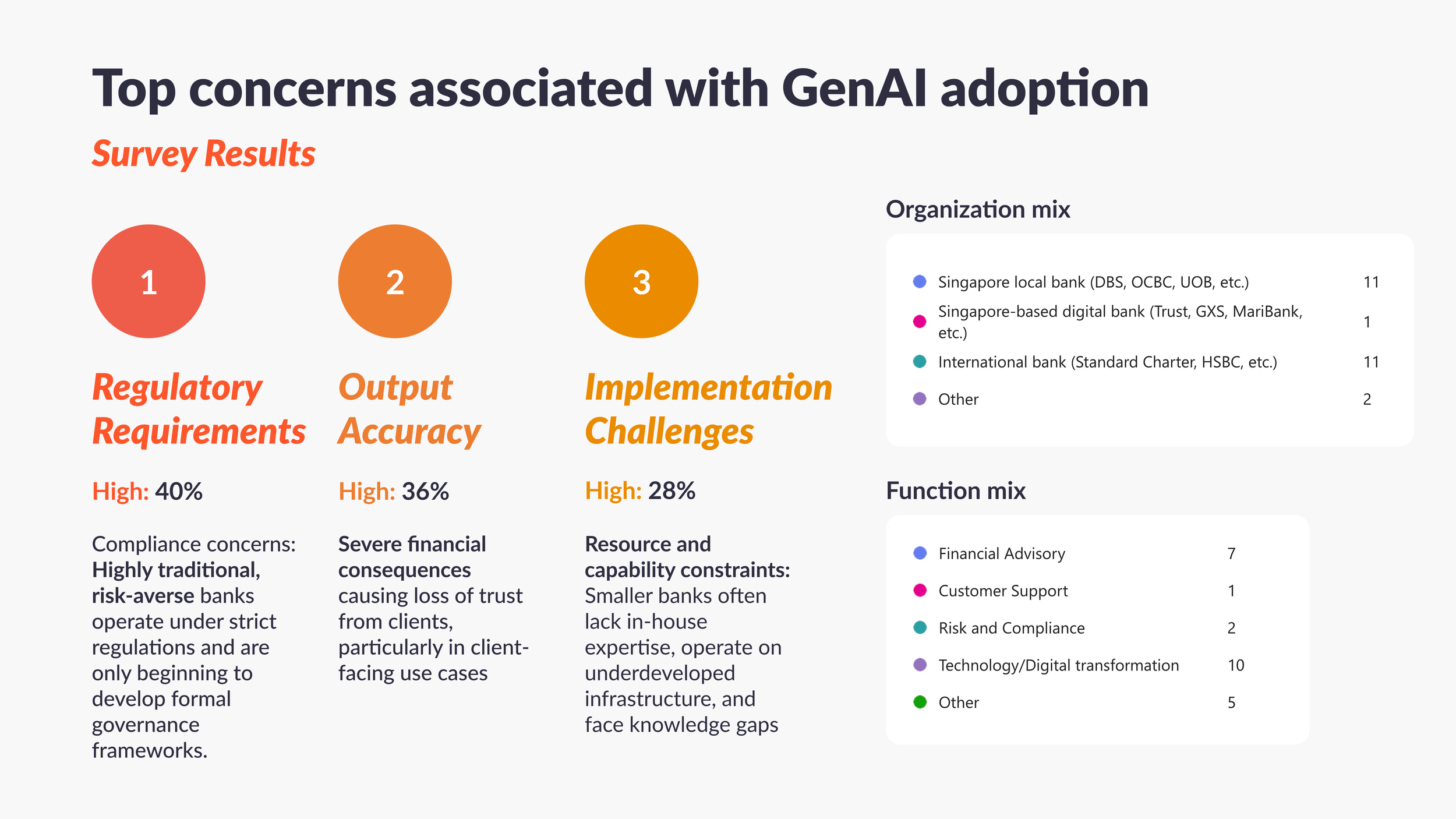

Looking into the outcomes of our recent survey on how bank employees evaluate challenges in adopting GenAI, which sheds light on the current perspectives on GenAI within the banking industry.

Let's begin with a breakdown of our survey respondents. The demographic distribution shows that 64% are from Middle Management, 20% from Senior Management, 4% from Top Management, and 12% from Junior Staff. This diverse representation provides a comprehensive view of opinions across different levels of the bank organization.

Our survey indicates a prevalent understanding among bank employees regarding the potential benefits of GenAI in banking. Notably, there is a general notion that GenAI can be highly beneficial, with Top Management also recognizing its value. This alignment across various levels underscores a unified vision towards leveraging GenAI technologies.

Interestingly, budget constraints appear less inhibitive, contingent upon the scale of the bank. This finding suggests that while financial resources are important, they may not be the primary hurdle, especially for larger institutions where investment in GenAI is seen as a strategic imperative.

We've moved beyond the initial phase of justifying the need for GenAI. Bank employees now understand the urgency and potential, thereby driving demand for its application. The spotlight has shifted towards addressing associated risks and challenges.

First and foremost, compliance with regulatory frameworks poses a significant challenge for banks, which are traditionally risk-averse and subject to strict regulations. Our survey indicates that many institutions are still in the early stages of formulating governance frameworks to navigate these complexities.

Another one of the primary concerns highlighted in our survey is the critical importance of output accuracy when deploying GenAI in client-facing use cases. Inaccurate outputs can lead to severe financial consequences, eroding trust with clients, particularly in customer-facing scenarios.

Implementation challenges including the lack in-house resources and expertise, may particular affect smaller banks. Successful GenAI deployment requires a deep understanding of the technology, which can be hindered by underdeveloped infrastructure, knowledge gaps, and a shortage of expertise within these institutions.

Insights from interviewees reveal concerns with a more big-picture lens

Interview feedback revealed a clear risk hierarchy and nuanced concerns around Gen AI adoption. At the top of the stack sit data-quality and trust concerns. Banks worry that poorly governed, unstructured data pools will feed models with low-grade inputs, undermining accuracy of GenAI outputs. This in turn fuels hesitation to deploy Gen AI in client-facing roles where a single error can erode credibility, as accurate data is crucial for informed decision-making and recommendations. Mid-tier risks are cost-benefit issues. Despite the sufficient budget within banks, executives cited the high upfront cost of model development and uncertainty over payback periods. The highly competitive environment in banking adds complexity, further complicating budget approvals and roadmap planning. Lower-priority is the spectre of over-reliance. Several leaders warned that as automation efficiency rises, output diversity could diminish, creating a feedback loop that dulls human judgment. By layering these perspectives, we gained a nuanced understanding not just of what banks fear, but why, and how the perceived severity of each risk shapes their GenAI timelines and investment appetite. Each identified risk area requires careful consideration and mitigation strategies to ensure successful integration and minimize potential drawbacks associated with GenAI implementation.

We recommend banks to tackle “universal” Gen AI use-cases that sit at the intersection of the front office, middle office, and data-tech teams before chasing niche ideas. By focusing first on cross-functional tasks that every bank shares—workflows that drive efficiency and automation, sharper decision-making, higher accuracy-and-compliance, and proactive risk or opportunity spotting—institutions can harvest quick, bank-wide wins while the technology is still maturing . Once these foundational gains are in place and the market & underlying models have progressed, banks can shift the arrow toward more specialised domains where GenAI’s competitive edge will be even greater. Research underscores that this roadmap must stay flexible: GenAI will look very different in a year, but it will be there, so governance and investment plans need built-in agility.

Prospective mitigation strategies to counter challenges in GenAI adoption

In the short term, focusing on high-priority initiatives is crucial for secure and reliable GenAI adoption.

Ensure Secure Deployment: We must implement robust security measures to safeguard GenAI deployment and regulate output quality, ensuring accuracy and reliability.

Improve Explainability: Enhancing the explainability of our AI tools will foster transparency, building trust among stakeholders regarding GenAI processes.

Enhance Data Privacy: Strengthening data privacy protocols is essential to protect sensitive information used by GenAI systems, ensuring compliance with privacy regulations.

In the medium term, empowering our workforce through education is key to responsible GenAI utilization.

Train Employees Responsibly: Comprehensive training programs will educate employees on responsible GenAI usage, emphasizing compliance and minimizing misuse risks.

Enhance Interdisciplinary Understanding: By fostering interdisciplinary understanding, we enable effective collaboration and utilization of GenAI across various business functions.

Looking towards the long term for internal development strategies and sustainable GenAI adoption.

On-Premise Adoption: Considering on-premise deployment of GenAI can be easier to manage and more cost-effective in driving adoption efforts over time.

Mitigate Data Leakage Risks: Implementing stringent data governance practices and continuous monitoring will mitigate data leakage risks associated with GenAI systems.

By prioritizing these prospective mitigation strategies based on urgency and timeframes, we can navigate GenAI adoption challenges effectively, ensuring a successful and impactful integration within our organization.

Where AI is used today

Traditional AI in Singapore banks is concentrated in pattern‑based, low‑risk workflows. On the customer side, chatbots handle routine queries while internal knowledge bases and summarisation tools shorten response times. In operations, document validation, data synthesis/compilation, automated transactions, and onboarding remove manual steps from repetitive processes. Higher up the value curve, risk assessment applies AI to large volumes of standardised documentation, and financial advisory emerges as a future high‑value arena. The overall picture: quick wins cluster in repeatable tasks; higher‑value use cases exist but carry greater risk and governance requirements.

Based on the 3-phase GenAI journey, there is room for growth for all of the major local banks

We frame adoption as a three‑phase trajectory. Phase 1 (Everyday tasks) delivers 10–20% productivity by automating routine work. Phase 2 (Critical functions) integrates Gen AI deeper into core processes, unlocking 30–50% efficiency. Phase 3 (New business models) moves beyond cost to create durable competitive advantage through new services and revenue streams. Each phase raises the bar on accuracy, auditability, and controls.

GenAI adoption status: most banks at least partially implemented Phase 1, and OCBC started implementation in Phase 2

Across the majors, most activity sits in Phase 1—general‑purpose tools (e.g., copilots) are now table stakes for boosting individual and team productivity. OCBC has begun Phase 2 with early moves into code generation and adjacent critical functions, while other local banks are positioned to expand into these areas over the medium term. Phase 3 is not yet in market, underscoring the growth runway that remains for all players.

Unlocking the value of GenAI sustainably

Progress through the phases requires balancing strategic growth with cost control. We recommend targeting >10% productivity gains in the near term and reinvesting savings, systematically upskilling staff to build a Gen AI talent base, and understanding long‑term cost drivers (infrastructure, model lifecycle, governance). At the same time, banks should develop an ecosystem of partners to accelerate delivery and embed Responsible AI practices—planning early for emerging policies and regulations. This combination turns near‑term efficiency into a repeatable engine for scaling Gen AI impact.