Old Chang Kee LBO Report

Venture Capital Private Equity Course Final Project | NUS MBA

Project Overview

Timeline: Oct - Nov 2025

Team Members: Sandro Merz, Taha, Terrence Lim Yi Jie, Yige Zhao, Zhengzhong Qu, Xu Liang

Core Deliverables: Final Report + Presentation deck assessing OCK as a leveraged buyout candidate. We followed a private‑markets workflow: company and industry diagnosis, thesis formation, dual‑track valuation (DCF + trading comps), proposed pricing and capital structure for a take‑private, a value‑creation plan across growth/cost/cash, and exit and returns modelling.

Investment Committee deck: company history, business model, market/competition, valuation, capital structure, value‑creation, exits; includes DCF, comps, and share‑price range exhibits.

Written investment report: mirrors the structure above (Origin & Timeline → Valuation → Investment Structure → Value‑Creation → Exits & IRR), with TAM–SAM–SOM and ratio analysis.

Valuation workbook: DCF (WACC 5.9%, flat FCF base, S$3.8/share diagnostic) + trading comps (EV/Revenue, EV/EBITDA, P/E).

Pricing & term sheet: S$0.92/share offer (≈20% premium), 63% debt / 37% equity, 10% mgmt rollover, board/control rights, and sources & uses.

Value‑creation plan & KPIs: Growth–Cost–Cash levers with 100‑day, year‑1, and year‑3 milestones.

Returns model: ~48% IRR base case at 7× exit + comparables compendium for trade‑sale benchmarks.

Company at a Glance

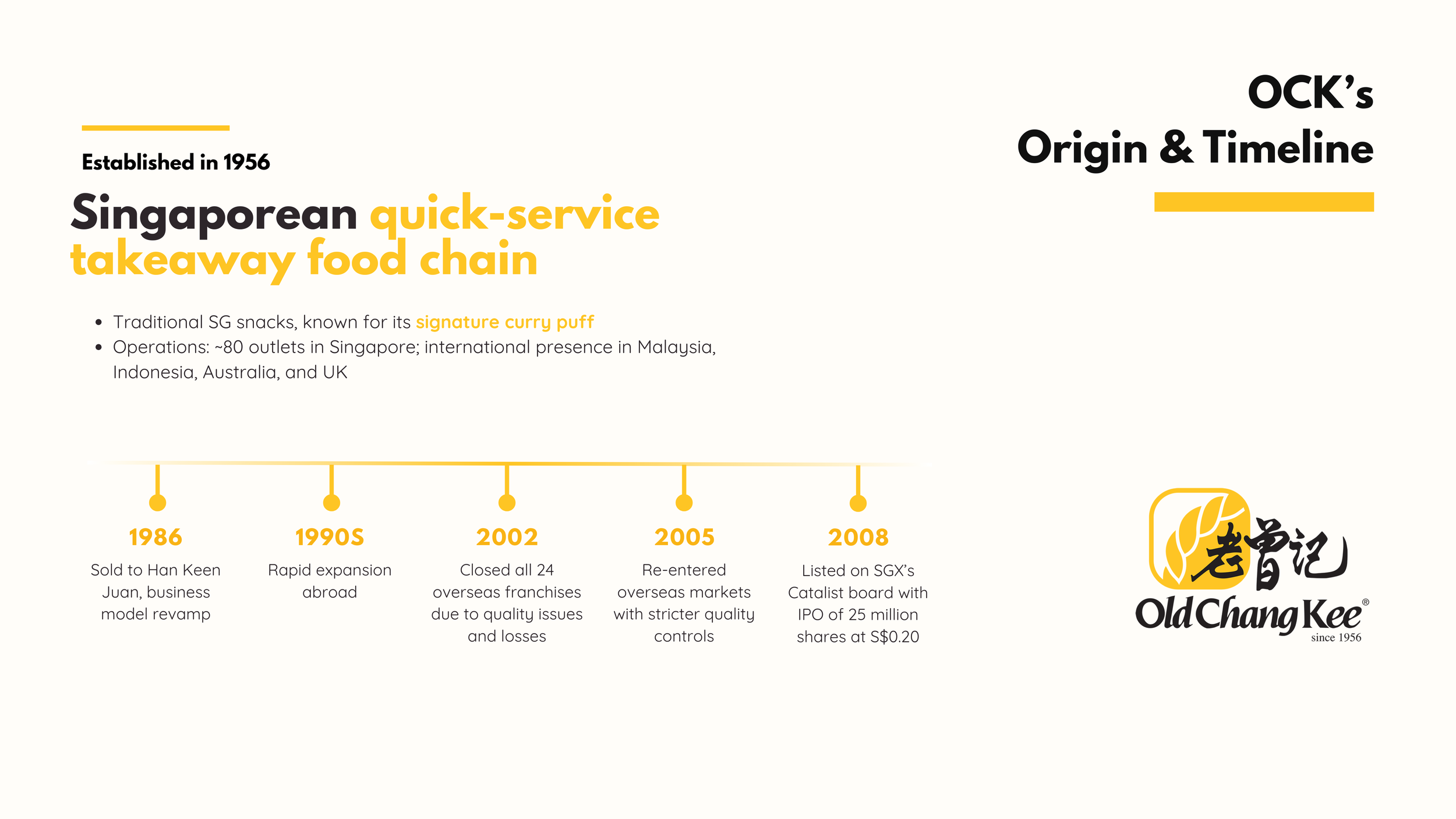

OCK is a Singaporean quick‑service takeaway chain established in 1956, operating ~80 outlets locally with selective overseas presence. After a 1986 ownership change, the business tightened quality control, re‑entered overseas markets in 2005, and listed on SGX Catalist (2008) to fund expansion.

Research & Diligence

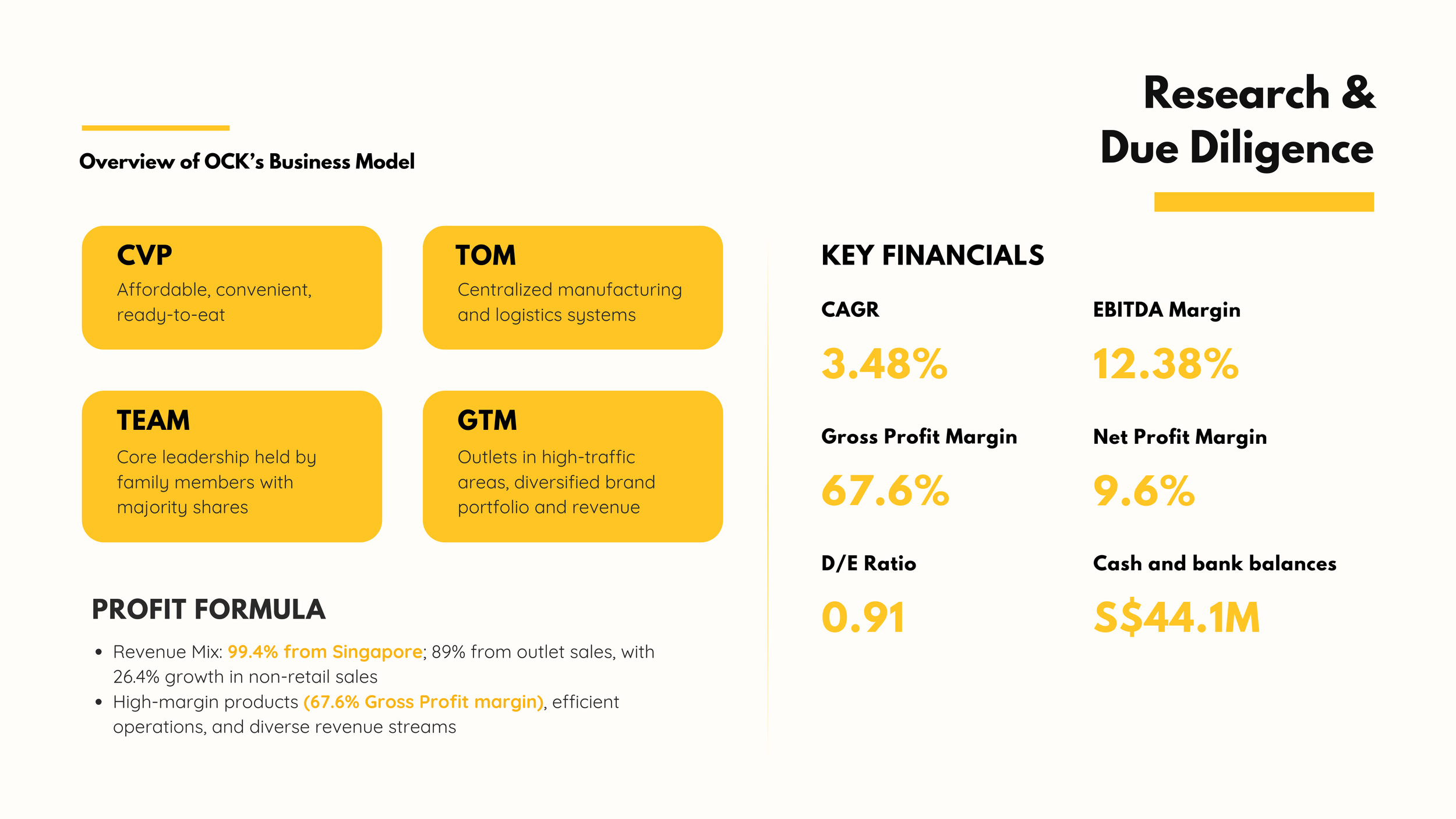

Our workstream combined: (i) business model teardown (CVP, TOM, team, GTM, profit formula), (ii) market sizing and competitive mapping, (iii) financial and ratio analysis, and (iv) dual‑track valuation (DCF and trading comps) feeding into deal design, governance, and a Growth–Cost–Cash value‑creation plan.

Business & Operating Model

Customer Value Proposition. Affordable, ready‑to‑eat local snacks in high‑traffic locations (MRTs, malls, transit hubs), with frequent product refresh for visit frequency. (Report “Overview of Business Model”.)

Technology & Operations. Centralised manufacturing (Iskandar, Malaysia) ensures quality consistency and scale economies across retail, delivery, catering, and wholesale channels. Non‑retail grew +26.4% in FY2024, signaling runway outside outlets.

Team & Governance. Long‑tenured, family‑anchored leadership (Exec Chair Han Keen Juan; CEO William Lim) with aligned incentives and execution discipline.

Financial Profile. FY2024: S$100.95m revenue; 67.6% gross margin; 12.38% EBITDA margin; 9.6% net margin; D/E 0.91; S$44.1m cash. Revenue split ~99.4% Singapore; ~89% outlet sales.

Implication: OCK has a clean production backbone with strong gross margins and a diversified channel mix provides cash‑generative stability and a base for repeatable store‑ and channel‑led growth.

Industry & Market Analysis

OCK sits in the QSR/snack segment of Singapore’s foodservice market, where convenience, delivery platforms, and healthier snacking are notable demand drivers. The domestic niche is competitive and fragmented, making brand strength and location quality key moats—while also highlighting the need to diversify beyond Singapore via capital‑light regional plays (e.g., franchising, frozen retail).

Investment Thesis

Brand & frequency moat in commuter nodes

Financial resilience (high GP%, ample liquidity) to fund growth

Clear growth vectors—ASEAN franchising, frozen retail, B2B (airlines/hotels), digital

Continuity of team with PE governance overlay

Risk‑aware diversification away from single‑market exposure and fried‑only positioning

Competitive & Deal Context

We benchmarked listed local comps (Soup Holdings, Kimly, Jumbo, Japan Foods, Tung Lok) and studied BreadTalk’s 2020 take‑private (S$0.77/share, 19.4% premium) to frame privatisation logic in Singapore F&B—simplifying governance burdens and enabling operational resets outside the public lens.

Valuation & Offer

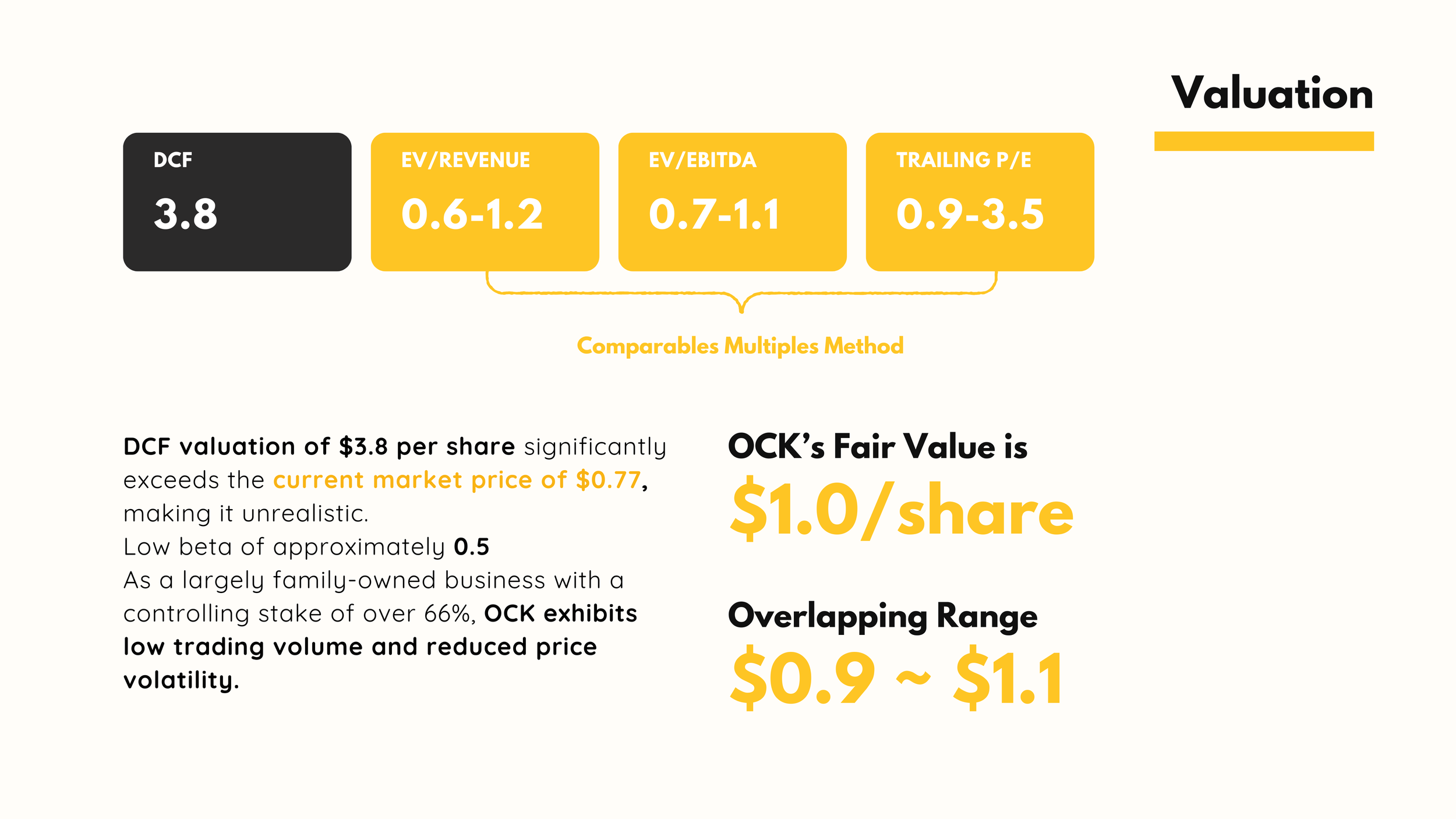

DCF (diagnostic). Low observed beta (~0.50) and WACC 5.9% inflate a S$3.80/share output—not decision‑useful for a tightly held small‑cap; we used it as a cross‑check.

Trading comps (decision basis). EV/Revenue 0.5–1.3×, EV/EBITDA 2.4–4.3×, P/E 11–44× imply S$0.90–1.10/share; we anchored fair value ≈ S$1.00.

Recommended offer: S$0.92/share—~20% premium to S$0.77 (25 Oct 2024)—at ~3.5× EV/EBITDA, balancing take‑private credibility with return potential.

Deal Design — Capital Structure & Governance

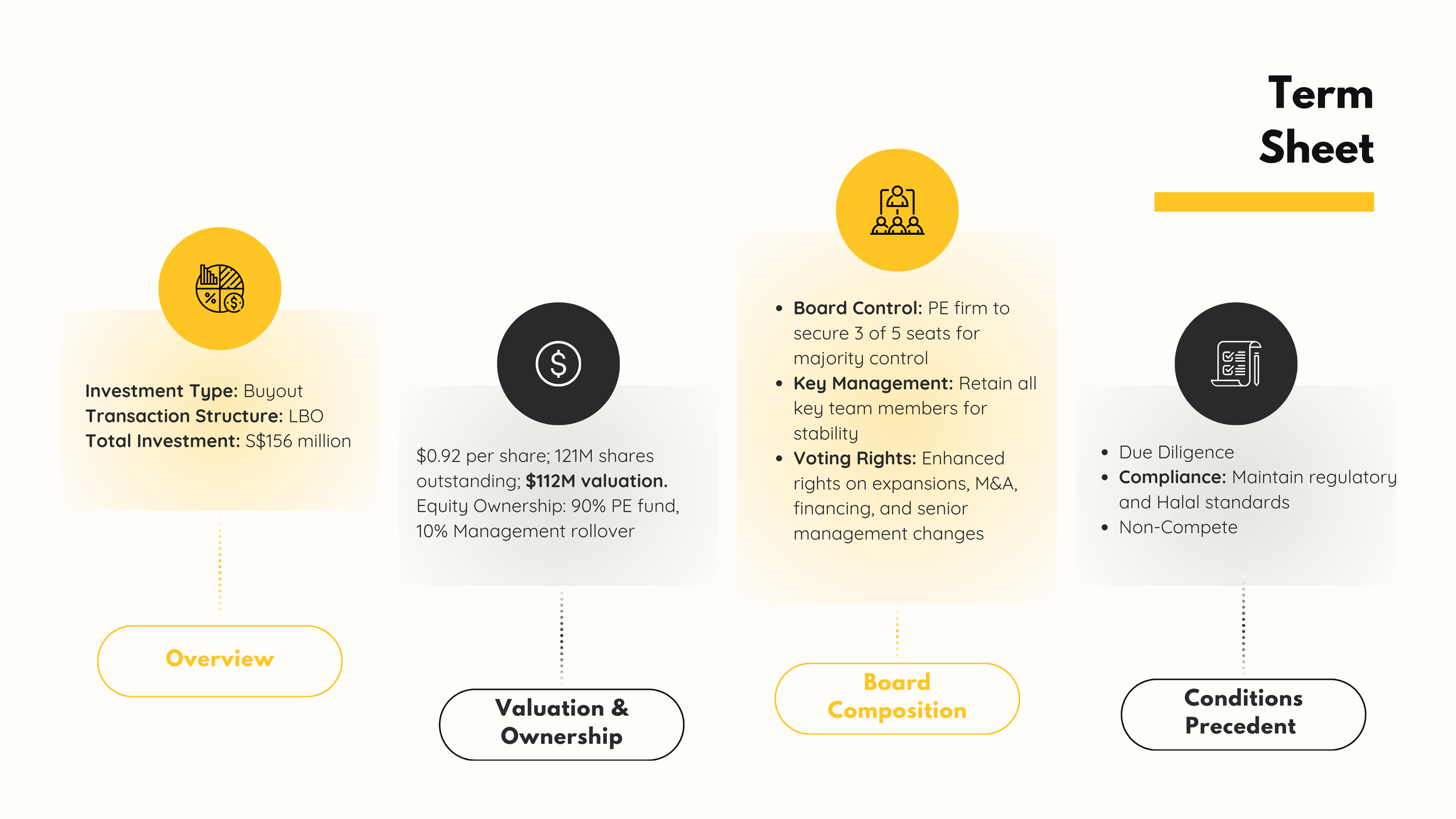

Sources & Uses: S$156m total consideration funded by ~63% senior debt (cash‑pay + PIK flexibility) and ~37% equity (incl. management rollover). Post‑LBO Net Debt/EBITDA ≈ 2.0×, preserving borrowing capacity for expansion.

Governance: Retain the full key team; 10% management rollover; PE controls 3/5 board seats with consent rights on large CAPEX, capital structure, senior hires, and liquidity events.

Value‑Creation Plan

Growth (Top‑line)

Healthier SKUs (low‑calorie/plant‑based) to hedge nutrition trends.

Frozen retail line in supermarkets and subscription snack boxes to build recurring revenue.

ASEAN franchising (capital‑light), expat‑hub pop‑ups/kiosks, and airline/hotel partnerships for B2B lift.

Cost (Bottom‑line)

Maximise Iskandar plant with automation/lean.

AI demand‑forecasting and energy‑efficiency retrofits across stores.

Cash (Working capital)

Improve DPO/DIO/DSO via supplier‑term negotiation, real‑time inventory, and digital payments to shorten the cash cycle.

Exit & Returns

Preferred exit: Trade sale to a regional strategic or global QSR consolidator; target IRR ~45–50% in 5–7 years. Base case: 10% revenue CAGR, steady margins, deleveraging → ~48% IRR at 7× exit.

Alternatives: Secondary sale, relisting, or MBO—lower preference on value/certainty.

Key Risks & Mitigations

Single‑market concentration (SG): Stage ASEAN franchising and frozen retail to diversify.

Health‑trend headwinds (fried foods): Introduce better‑for‑you variants; adjust positioning and bundles.

Overseas execution risk: Tight SOPs anchored in the central facility; selective franchisee vetting; unit economics tuned to local rents/wages.

Competitive intensity: Defend location quality, speed, and digital convenience (delivery, order‑ahead).